Territories participating in the Ongoing Distribution for which Deloitte Consulting Ltd. is responsible

The territories participating in this distribution, known as the “E.C participating territories” are Antigua & Barbuda, Dominica, Grenada, St. Vincent and the Grenadines and Montserrat.

Although Montserrat has a separate Judicial Manager, it has opted into the regional distribution. We will work collaboratively to facilitate the distribution of funds to Montserrat policyholders.

Anguilla however, has opted out of the regional pooling of assets and will not be included in this distribution. As a result, policyholders and claimants in Anguilla will receive distributions directly from assets realized within that jurisdiction.

Select Your Country from the display of flags for the EC Territories for country-specific updates.

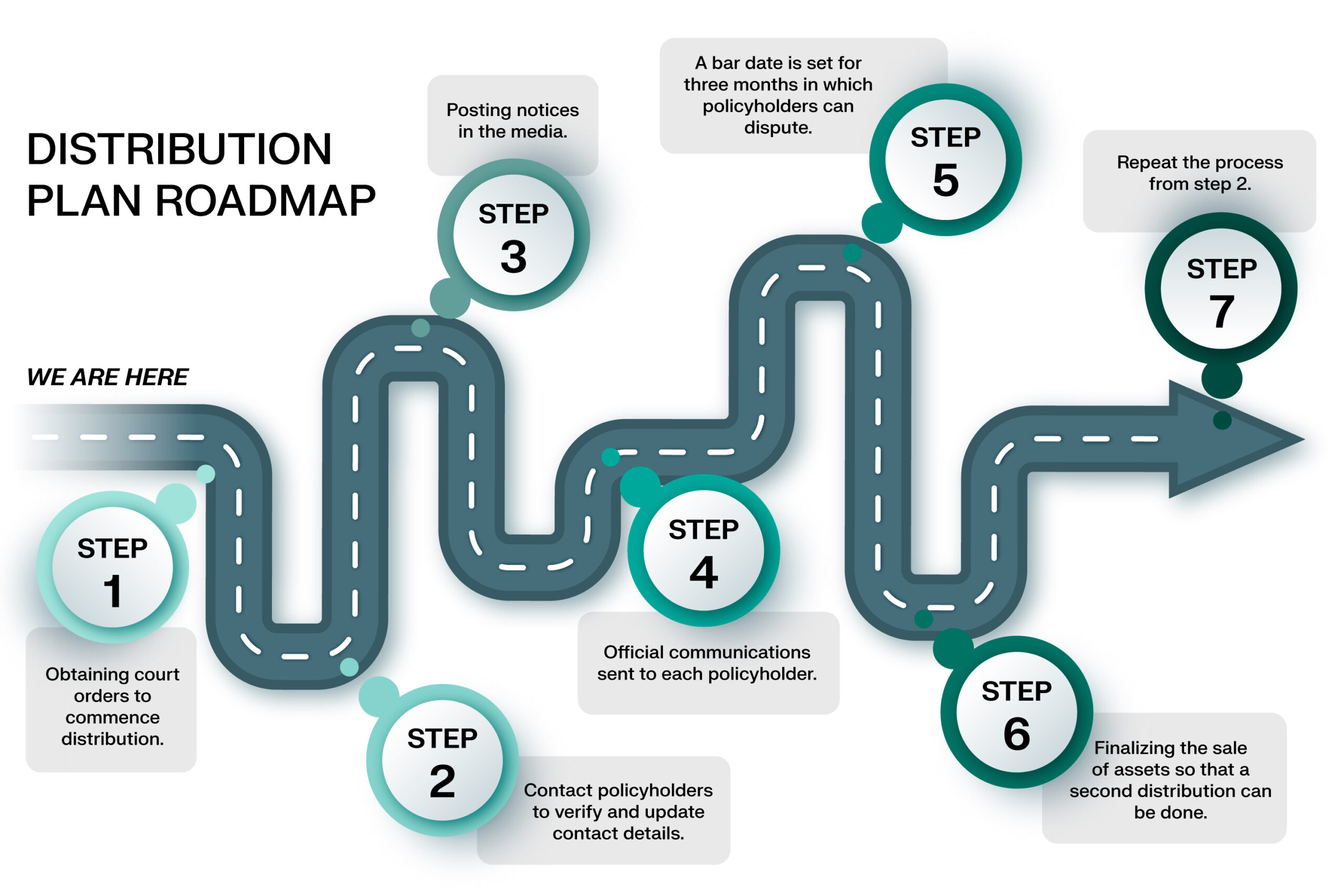

Next Steps for Policyholders

Policyholders and other claimants can expect to be contacted individually to confirm the details of their policies or claims. The Judicial Manager is working closely with governments, regulators, and courts in each jurisdiction to finalize a resolution strategy. Please select your appropriate country for island-specific details.

The Judicial Manager continues to work closely with its legal team, regulators, and the Courts to obtain consent orders for all participating Eastern Caribbean territories.

At this time, we advise all active policyholders in Grenada to monitor local newspapers, radio broadcasts, and this website for updates regarding the distribution of funds. Grenadian policyholders are encouraged to click on their designated territory page for more detailed information.

All other active policyholders are similarly advised to regularly check this website for updates, as new information will be published as it becomes available.